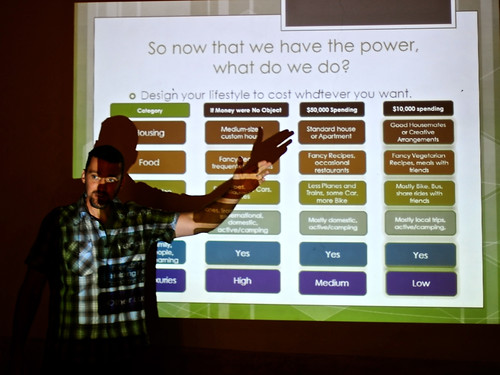

Yesterday, I gave a presentation on my “Be Your Own CFO” concept to subscribers of Leo Babauta’s Sea Change program. For an hour, I talked about how (and why) to treat your personal finances as if you were managing a small business.

As always, one of the key components of my message was that people ought to do what they can to save money on the big stuff. By making smart choices in just three areas — housing, transportation, and income — you can achieve outstanding personal profit with minimal effort. That is, you can create a huge gap between your earning and spending if you’ll take steps to reduce your housing costs, trim your transportation expense, and increase your income.

Obviously, these things are easier said than done. If you’ve already bought a large, expensive house in suburbia, it’s tough to simply say, “I’m out of here.” For one, it takes time to sell your place and move into something smaller (and cheaper). For another, if you’re accustomed to a certain lifestyle, the transition to something more minimal can be shocking at first. (Although, from the people I’ve talked to, once the transition is made, it’s easy to maintain the new modest lifestyle.)

What was different about yesterday’s presentation, though, was the role that cost of living played in my thoughts — if not my actual delivery.

Right now, Kim and I are stranded in rural South Dakota. While driving from the Badlands to De Smet (real-life site of Laura Ingalls Wilder’s “little town on the prairie”), our RV engine blew up. For the past week, we’ve been stuck in Plankinton (population 707) while we wait for a new engine to arrive and be installed.

I won’t pretend that Plankinton is paradise. It’s hot and humid here. There’s little to do besides sit and drink beer with the locals during the evening. (Which is fun, don’t get me wrong.) There aren’t a lot of job opportunities. The socio-political vibe doesn’t match our own.

What Plankinton does have, however, is cheap prices. This morning, for instance, I paid $10.60 for a fancy men’s haircut. At home in Portland, I pay $28 for the same fancy haircut. Six weeks ago, I paid $30 for the same cut in Fort Collins, Colorado. In Santa Barbara, California, I paid $50 or $60 for the same fancy cut.

Gas is cheaper here too. So is food. So is beer and whisky. So are movies. So is just about everything, including housing. Housing prices follow a similar pattern to the haircut prices I mentioned above. A $280,000 home in Portland might go for $300,000 in Fort Collins and $500k to $600k in Santa Barbara. Here in South Dakota, that same home would cost about $106,000.

Cost of living differences can be huge from one country to another, from one state to another, and from one city to another. In large cities, there are even differences between neighborhoods. (Groceries are more expensive in Portland’s posh West Hills than in low-rent Oak Grove, for instance.)

For fun, take a look at CNN’s cost-of-living calculator, which will allow you to compare expenses from one city to another. For instance, here’s the difference between home and here:

The lesson here? If you truly want to achieve a Big Win on your housing costs, it pays to expand your search, to take into account cost of living. If you have a fixed budget, you’ll get more bang for your buck by buying a house in Oklahoma City or Sioux Falls than by purchasing in San Francisco or Seattle. If, like me, your work is location independent, it makes much more sense to live in Omaha, Nebraska than New York City. Your income is the same in both places; but in Omaha, your get much more for your money.

Now, obviously there’s more to consider in a decision like this than pure price. As I always say, money management is more about mindset than math. We are emotional creatures, and we don’t make financial decisions based purely on the numbers. When you choose a place to live, you do so because of the climate, the politics, and the people. You want to live close to friends and family. You want a nice school district. You want people who think and act the same way you do. For those reasons (and others), South Dakota might not be a good choice for you.

But I believe you should take cost of living into account when deciding where to live. Housing is far and away the largest piece of the average American budget, roughly one-third of the typical household spending. The best way to cut your costs (and, therefor, boost your profit/savings) is to reduce how much you spend on housing. And the first step in reducing your housing expense is to choose a cheap place to live.

Every morning when I get out of bed, I pour a cup of coffee and sit down at my computer. While I wait to wake up, I browse my favorite websites. This morning, as I was browsing

Every morning when I get out of bed, I pour a cup of coffee and sit down at my computer. While I wait to wake up, I browse my favorite websites. This morning, as I was browsing